Last month, Hurricane Ian devastated communities across the state of Florida, leading to more than 100 deaths and billions of dollars in damage. According to the catastrophe modeling firm RMS, privately insured losses are expected to reach as high as $67 million, making Ian second only to Hurricane Katrina in terms of economic destruction. Unlike previous storms like Katrina and Hurricane Andrew, however, today’s scientists blame climate change for the increasing regularity of severe weather events. That means experts see Ian as part of an upticking trend, not an isolated event.

Last month, Hurricane Ian devastated communities across the state of Florida, leading to more than 100 deaths and billions of dollars in damage. According to the catastrophe modeling firm RMS, privately insured losses are expected to reach as high as $67 million, making Ian second only to Hurricane Katrina in terms of economic destruction. Unlike previous storms like Katrina and Hurricane Andrew, however, today’s scientists blame climate change for the increasing regularity of severe weather events. That means experts see Ian as part of an upticking trend, not an isolated event.

All of this increased risk leads to higher insurance premiums, which were already hefty before Ian but now stand to soar to previously unseen heights. “You can’t just build in high-risk areas indefinitely, and expect it to be insurable at an affordable rate,” said Zac Taylor from Delft University of Technology in the Netherlands. If home buyers can’t afford to purchase insurance, then they won’t be able to obtain mortgages, potentially leading to a situation that prevents all but the highest earners from buying property in Florida. “You need a private insurance market to have a mortgage market,” said Taylor. “Will working- and middle-class homeownership remain viable in Florida in the long term?”

The state’s insurance market was already fragile before Ian: after Hurricane Andrew most large insurance firms either left Florida entirely or drastically cut back their business. Policyholders in the state must deal with smaller insurers that often do not keep much reserve cash on hand, relying instead on “reinsurers” abroad for money when a big policy pays out. Unfortunately, these reinsurers negotiate their contracts with Florida firms on an annual basis, and this year could likely be the one where they decide to raise rates to unsustainable levels. “You’ve got to keep reinsurers happy if you want to have reasonable rates for consumers,” said insurance executive Joseph Petrelli. As another risk and compliance expert put it, the aftermath of Hurricane Ian will “test this system that frankly has a lot of broken pieces to it.”

Questions:

- How will the aftermath of Hurricane Ian likely upend Florida’s real estate market?

- Why do many large insurance companies avoid doing business in Florida? What impact has this had on the insurance industry and policyholders in the state?

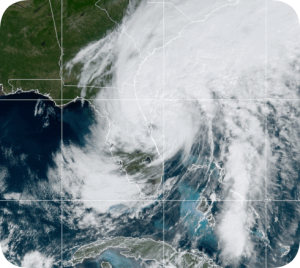

Source: Christopher Flavelle, “Why Ian May Push Florida Real Estate Out of Reach for All but the Super Rich,” The New York Times, October 13, 2022. Photo by STAR – NOAA / NESDIS.