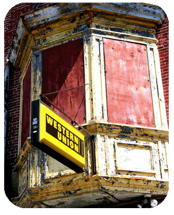

Recent federal banking regulations have placed limits on the fees that financial institutions can charge for things like overdrafts and credit card transactions. Although this has been good news for consumers and merchants, the new rules have reduced revenue streams for banks across the country. As a result, many institutions are looking to make up the difference through additional sources of income, such as Western Union branches.

Recent federal banking regulations have placed limits on the fees that financial institutions can charge for things like overdrafts and credit card transactions. Although this has been good news for consumers and merchants, the new rules have reduced revenue streams for banks across the country. As a result, many institutions are looking to make up the difference through additional sources of income, such as Western Union branches.

The more than 160-year-old money-wiring firm sells its services to 52,000 locations throughout Continue reading