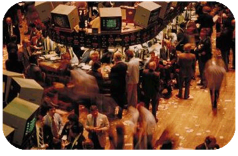

Trading commodities is a complicated business. Employees in the industry not only have to possess financial intelligence, they also must be able to seemingly predict the future based solely on projections and estimates. For years traders like these thrived in the “pits” of Chicago and New York’s stock exchanges, shouting about everything from livestock to produce as they searched for deals. These financial foot soldiers eventually became pop culture icons, with frantically yelling floor traders appearing in everything from serious films to cartoons.

Trading commodities is a complicated business. Employees in the industry not only have to possess financial intelligence, they also must be able to seemingly predict the future based solely on projections and estimates. For years traders like these thrived in the “pits” of Chicago and New York’s stock exchanges, shouting about everything from livestock to produce as they searched for deals. These financial foot soldiers eventually became pop culture icons, with frantically yelling floor traders appearing in everything from serious films to cartoons.

But as with so many other aspects of the recent past, computers and digital analysis have taken the place of the common commodities trader. Chicago will close up all of its trading pits this month while New York is gradually phasing out the practice as well. The shuttering of the pits has long been expected as ever-improving technology and high frequency trading have become the norm in both financial hubs. As a result, the trading pits have become emptier with each passing year. The few occupied pits that remain are populated with people working on computers, remaining on the trading floor for no other purpose than the familiar atmosphere.

The passing of this profession may not seem too important, especially considering the robust health of the financial sector as a whole. But unlike many people working in the industry, commodities traders often came from blue-collar backgrounds and used their positions to start their ascent up the corporate ladder. After all, people didn’t need an Ivy League degree or family connections to get into the pits: all they needed was a sharp mind and a forceful personality. With this entrance to the industry now closed, however, aspiring financial experts will likely need at least an MBA if they want their careers to progress. In fact, higher education is increasingly becoming a standard requirement for employees in industries across the board. So even though the ways people do business may change, the value of a college education remains immeasurable.

Questions:

- What are the chances of trading pits making a comeback?

- Why is a college degree becoming a must for trading positions on Wall Street?

Source: Ryan Carlson, “The Fading Features of Trading Pit Tribes,” Financial Times, June 14, 2015.